With that said, some repairs and improvements are not necessary and you won't get a good return on your investment.

|

One of a seller's biggest mistakes can be avoiding a repair before putting the house on the market. Even though it makes sense to provide an allowance for the repairs, the reality is that a buyer often can't see past the necessary repairs. And, the ones who do, are most often looking for a great deal.

With that said, some repairs and improvements are not necessary and you won't get a good return on your investment.

1 Comment

Now is an awesome time to sell. If you tried before to get your home sold. You should know that inventory is at a historic low, and you can definitely sell your home in this market.

When you are pricing your home, put yourself in the buyer's shoes. And, if you wouldn't pay that much, why would they?

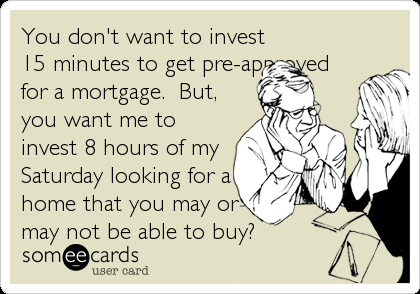

I created that ecard to be funny. But, the underlying principal has merit. Going out to look for a home prior to being approved is a waste of time. Not just your agent's time, but yours as well. It very disappointing to a buyer to fall in love with a home that they don't qualify for. And, that is just one facet. Here are the reasons that you should get pre-approved for a mortgage before shopping for a home.

#1) Get a realistic budget. But, getting pre-approved gives you an idea of what you can afford, but ALSO what it will cost you on a monthly basis. When you get it down on paper, you may decide that you want to be well below your maximum approval amount. It is hard to think logically about that when you have fallen in love with a home that is above that limit. #2) Credit reports are often incorrect. If you wait to find the house before you get a pre-approval, you may not know about the apartment complex that sent you to collections improperly. Or, the item that got put on your credit report by mistake. Nothing more frustrating than finding a house, knowing you can afford it, but not being able to get a credit issue resolved in time to buy it. #3) Shopping completely out of your price range. It is one thing to fall in love with a home you qualify for, but is more than you want to spend per month. It is another altogether to find a home that is just out of your price range altogether and there is no way for you to buy the home. If you are looking in the 250k range, and then have to drop to 200k, you will have set yourself up to most likely be disappointed in the house that you eventually get. And, buying a home should be an exciting and happy time, not a time of begrudging settling. #4) You may be able to afford more than you think. Interest rates are way low, and the cost of home ownership is lower than it has ever been. Not to mention that there are tons of programs for 100% or near 100% financing, or very low down payments. So, if you meet with a qualified mortgage specialist, you may find that you are able to buy more than you ever thought you could. This is not as rare as you would think. #5) This is probably one of the biggest factors in the whole deal. We are in a seller's market. Sure, prices are still repressed and buyers can still get a good deal. However, there is the lowest inventory of homes we have seen in 12 years. From a months supply of inventory standpoint, this is the lowest inventory our area has ever seen historically since they began tracking the statistic. Seller's can be picky. If you don't have that piece of paper that takes 15 minutes to get, a seller will bypass your offer and go to the next one that is pre-approved. And, by the time you get notice that you are pre-approved and resubmit the offer, that home will have likely gone under contract. That is, if it is priced right and in good condition. The bottom line is that 15 minutes is a small time investment. In the end, it will save you time, it will save you hassle, and it not getting it may prevent you from getting the exact home you have been looking for. Real Estate market continues to improve nationally. From a local perspective, inventory is so low right now, it is ridiculous. Now is a great time to sell or buy. For sellers, inventory is low and there is much less competition from short sales and foreclosures. For buyers, it is a combination of prices that are still well off their highs and very low interest rates.

This is the third part of the series. The first two talked about ways to avoid to foreclosure, this last part will talk about what if you are staring down a foreclosure and there is no avoiding it.

Perhaps you have tried to modify, tried to sell, or perhaps, you didn't do anything until it was too late. What now. Well, first off, life will go on after the foreclosure. The sun will still rise and the sun will still set. So, lets talk about the big 'F' word. The ramifications, and also your rights. Understand that I am in Georgia. So, laws in your state may vary slightly. So what happens on the day of a foreclosure? Basically, an attorney will stand on the courthouse steps and auction off your home. Most of the people at the auction are investors looking for a deal. In many cases, the bank will have a minimum bid higher than the investors want to pay. At that point, the bank becomes the owner of the property. If the starting bid is low enough, the owner will be whoever bids the highest. So, what should you do before foreclosure? #1) Don't move. If the bank receives the property back, they have cash for keys programs and you can get a thousand or so dollars to move out within a specific time frame. Usually two weeks from the time that they approach you. Also note that many times the offer made is below what they are willing to pay. So, you have the opportunity to negotiate. If an investor buys the property, they too may elect to pay you cash to leave the property in good shape. Otherwise, they will have to go through the eviction process which could take a month. Remember, no one can just show up and force you to leave without proper legal process, including the eviction process. #2) Don't tear up the house. I realize that you may be very angry. The reality is that if you leave the house in the shape it is in, you can qualify for a cash for keys program, or the investor may pay moving expenses. But, if the house is torn up, they have no incentive to pay you to keep it nice. And, any money you would get off Craigslist for second hand building materials should be eclipsed by what you received from the cash for keys program. #3) Breathe. Yeah, it sucks. Yeah, it feels like the world will end. It won't. In six months, you will hardly think about it. So, what about after foreclosure? #1) There will likely be a deficiency. A deficiency is the difference between what the bank gets for the property and what the loan balance was. The bank may or may not write this off. If they don't, you can often call and negotiate a lesser amount to 'settle' the account. If they do, they will mail you a 1099. If the property is a personal residence, this should not be taxable. Make sure to verify the person that is doing your taxes is aware of whether it is a primary residence or not. In recent years, lenders holding first mortgages are not typically going after borrowers for deficiencies. #2) If there was a second mortgage, it is not wiped away. There is obviously no collateral, but there is still a legal requirement to pay that debt. The first mortgage company will get something either from the courthouse steps or from selling the property. The second mortgage company, most of the time, gets nothing. So, they are much more likely to continue to pursue you for payment. Again, in these cases, you can settle the account for less. In many cases, you can get very favorable terms. Many think that once the foreclosure is over, they don't have to worry about paying any of this money back. That is not necessarily the case. #3) It is going to be at least three years before you can buy another home. At that time, you will have to fully explain why you were in this situation and underwriters are going to look much harder at this than a short sale. |

David and Amanda BlantonMake the Wise Move! Categories

All

Testimonials 557886  David is awesome to work with. He knows the area very well. He is extremely responsive, always took my calls and answered my emails and txts. He truly ... more David is awesome to work with. He knows the area very well. He is extremely responsive, always took my calls and answered my emails and txts. He truly ... more   5.0/5.0 5.0/5.0 by philipkupersavage 557657  David was extremely helpful.....We were very picky buyers & he never pressured us to look at a house outside of our parameters or place an offer... he ... more David was extremely helpful.....We were very picky buyers & he never pressured us to look at a house outside of our parameters or place an offer... he ... more   5.0/5.0 5.0/5.0 by dwcourter 309784  Mr. Blanton helped us find the home of our dreams and he did by listening to what we wanted. He taught us about the housing market, guided us in the ... more Mr. Blanton helped us find the home of our dreams and he did by listening to what we wanted. He taught us about the housing market, guided us in the ... more   5.0/5.0 5.0/5.0 by user30821228 Archives

May 2016

Categories

All

|

RSS Feed

RSS Feed